Digital currencies known as stablecoins are backed by the value of an underlying asset. As we’ll cover later in this post, each coin has a different underlying asset. Numerous stablecoins have a 1:1 relationship to fiat currencies traded on exchanges, including the US dollar or the Euro. Other stablecoins, such as those tied to precious metals or even other cryptocurrencies, are backed by assets than gold.

Stablecoins A Preferred Choice For Many

Stable Value And Zero Volatility

Stablecoin is supported by a consistent supply of fiat money. This allows for any type of currency fluctuation while increasing the stability and security of the Asset-Backed Stablecoin Development Company. Update it automatically if a new currency is launched or the value of the currency network changes. You will be able to access this updated value and carry out transactions after it. Additionally, it incorporates decentralized elements that offer a trustworthy peer-to-peer exchange network.

Fluidity

One of the numerous advantages and benefits of stablecoin technology is its ability to maintain network liquidity and flow. Numerous businesses will be able to raise money for brand-new initiatives safely and securely thanks to this ground-breaking technology. The budget is stable while this network is being built. Additional tokens are automatically spent to ensure the project’s overall stability if the cost is anticipated to increase.

Transparency

All cash transfers from one region of the world to another are transparent thanks to stablecoin technology, which is based on the Asset Backed Stablecoin Development Company. This will enable you to maintain the privacy of your data and information while eliminating all difficulties in accessing it. The particulars of the transaction will be entirely under your and your customer’s control.

Types Of Stablecoins

Fiat Collateral Stablecoins

The most typical stablecoins are those that are backed by fiat money as collateral. One stablecoin is equivalent to one unit of currency in stablecoins backed by fiat, which have a 1:1 ratio. Each stablecoin is backed by (theoretically) real fiat money that is kept in a bank account.

The manager of the stablecoin will deduct the required amount of fiat from their reserve and transfer it to the customer’s bank account when they want to swap their coins for cash. After that, the corresponding stablecoins are “burned,” or permanently taken out of circulation. The most basic Asset Backed Stablecoin Development Company type is fiat-collateralized stablecoins, and simplicity offers several benefits.

Commodity Collateral Stablecoins

Stablecoins that are collateralized with commodities are backed by a variety of movable goods. The most often collateralized asset is gold. There are also stablecoins backed by oil, property, and various precious metals.

Holders of stablecoins backed by commodities are essentially exposed to the value of a real-world asset. Over time, the value of these assets may increase or decrease, affecting the incentives for trade. It is occasionally claimed that stablecoins backed by commodities will make certain asset classes, including real estate, more affordable for smaller investors.

Crypto-Collateral Stablecoins

Crypto-backed stablecoins are potentially more decentralized than their fiat-backed equivalents because everything is carried out via blockchain technology.

These stablecoins are usually over-collateralized to absorb changes in collateral value, lowering the risks associated with price volatility. Stablecoins that are backed by cryptocurrency are more complex and haven’t gained popularity as quickly as other options.

Stablecoin Development

Before the development process begins, stablecoins are tied to either cryptocurrency, gold, or cash to serve as their collateral base. They can be fully backed by the US dollar or other fiat currencies, depending on the needs of your enterprise.

This is very similar to currency pegging, which is typically done by central banks in countries with headquarters. Finding a group of skilled blockchain developers is typically the toughest hurdle in the development of a stablecoin. A stablecoin development company should also have experience offering a variety of stablecoin development and creation services. Here are some of the most important steps to take into account while creating a stablecoin for your business.

Finalize The Stablecoin You Want To Launch

You must first perform market research and choose the kind of stablecoin you want to create for your business before you can begin creating your stablecoin. Stablecoins come in four main categories, as was already mentioned. A stablecoin may be collateralized, crypto-collateralized, or backed by a commodity, or it may not. It’s challenging to compare them. However, you can get assistance from a fintech research company or a professional Blockchain development agency to select the finest stablecoin for your market.

Finalize The Blockchain Tech Stack Development

After deciding on the stablecoin type your company needs, you must pick a blockchain platform to create it on. Stablecoin production used to only be possible on the Ethereum blockchain, however that is no longer the case. Therefore, choosing the base of your prospective stablecoin in advance is crucial.

Mechanism For Maintaining Liquidity

Because liquidity is a stablecoin’s defining feature, it must be preserved at all costs. The entire stablecoin process could be rendered meaningless if liquidity is lost. To avoid becoming caught in the demand-supply circle with your stablecoin, heed the counsel of a knowledgeable crypto or financial expert.

Transaction Fees

One source of income that needs to be shared with the stakeholders is transaction fees. Stablecoin partners should receive a portion of the revenue generated from transaction fees. In order to keep the liquidity level high, the remaining revenue must be deposited into the liquidity pool.

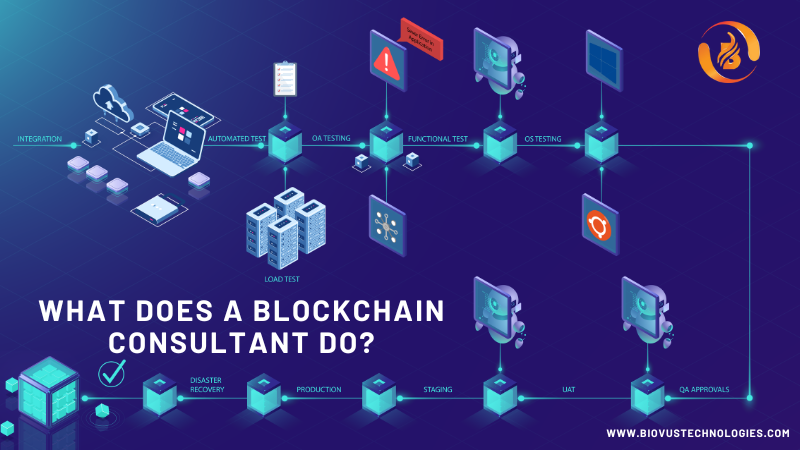

Final Deployment On Mainnet

You must build the system when you’ve completed designing your stablecoin. During this phase of development, developers will create smart contracts that talk to a stablecoin and set up nodes on the blockchain. Once all of your essential features have been created and connected to the blockchain, you can deploy the stablecoin on the test net.

If you establish a stablecoin using the Ethereum blockchain, you can come across several test nets in the cryptocurrency market. After that, check your stablecoin’s quality on the test network. Launch it on the mainnet if you’re pleased. You can get ready for final deployment after completing your stablecoin design. During this stage of development, smart contracts will be integrated with the stablecoin’s interface and the blockchain’s release notes. Release the stablecoin to the mainnet whenever you are happy with the testing.

The goal has always been to develop cryptocurrencies that are more liquid and less hazardous than traditional digital currencies. The “Gods of Coins” are what the cryptocurrency community refers to as stablecoins. It might make frictionless transactions easier. Work with a stablecoin development company immediately to get your stablecoin.

visit us on: www.biovustechnologies.com